The Name's Bond...Municipal Bond.

How municipal bonds are essential for getting projects done

Municipal bond ratings are critical to a city’s success. It’s a great accomplishment to have maintained a stable and highly-graded rating over the course of the last decade amidst many economic challenges such as the COVID-19 public health emergency, housing shortages, and global inflation.

My goal with this edition of “The Buzz” is to break down the elements that go into our bond rating in terms that are easy to digest and answer questions we didn’t have time to cover in the video.

The video breaks down what a municipal bond rating is. But can you back up and explain what a municipal bond is?

It’s easiest to think of it as a loan. Except instead of going to a bank and borrowing money, bonds can be issued to any investor, including the public in some instances. That investor in effect “buys” that debt and becomes a creditor. The bond issuer—in our case, the City of Worcester—is then on the hook to pay back the amount of the bond, with interest.

And the rating makes investing in bonds more attractive?

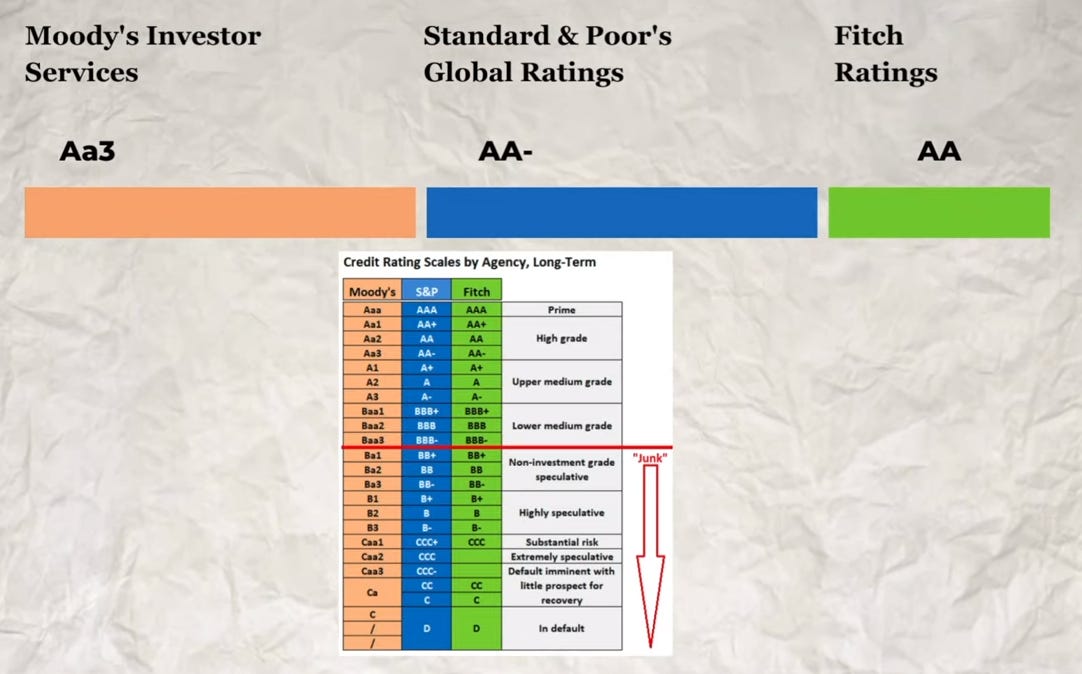

Yes. Ratings essentially denote how risky it would be to invest in a municipality’s bond. The higher the rating, the more confident investors are that the risk of default is low based on the municipality’s track record and current financial situation. That makes it easier to issue bonds and generally reduces the interest cost, since investors will be willing to accept less for a “sure thing.” Entities are more likely to invest because they are comfortable that you can pay them back. The lower the rating, the less likelihood you have of finding a creditor and the higher price you’ll pay to those few interested.

The chart in the video illustrates the rating scale. But what does it mean that Worcester is “stable?” Does that mean we’re just staying the same?

In essence, yes, but it actually has a more technical meaning. The grade itself is accompanied by an outlook, which is like a medium-term gauge of how the grade could change. Possible outlooks are positive, negative, stable, and developing. Stable is a great outlook to have because it signals that we can continue to explore areas for growth and work toward a positive outlook. Otherwise, we’d have to slow down and address impending challenges to ensure our rating doesn’t fall.

Why do we need to issue bonds in the first place? Aren’t tax dollars supposed to pay for everything?

You’re correct that tax dollars and other municipal revenue streams do cover municipal operations and initiatives. But for certain projects like new schools, vehicles, water and sewer lines, and public parks, those costs are spread out over time, which is where bonds come in. Taking the park example, it’s something that will be enjoyed by residents and taxpayers for a long time. But municipal taxpayers come and go during the park’s lifespan, so it’s not necessarily appropriate for just one year’s taxpayers to cover the entire cost. Instead, that cost is shared across different years so that all those who enjoy the benefit of the park are involved in paying for that park.

Additionally, paying for day-to-day operations leaves only so much money left to pay for capital projects, so we don’t have enough unused capital to invest in a new school whenever we’d like to build one. Much like an individual financing a car or taking out a mortgage, we use bonds to pay for major capital expenses. By borrowing money, we are able to afford smaller payments annually to cover the larger payment due over the course of 30 years. We do pay interest on it, just like a mortgage, but it allows us to make these longer-term investments without “breaking the bank.”

OK, so if you don’t issue bonds, not a lot will get built. But isn’t debt a bad thing?

Debt in and of itself is not a bad thing for the City. What matters is your ability to manage and pay off that debt. Every year, we incorporate how much we need to pay towards debts—a value referred to as “debt service”—into the operating budget, as well as our capital budget. As long as we’re making our payments on time and can show our ability to manage our debt effectively, our rating will continue to stay stable and can even increase. And once a bond debt is fully paid off, that allows us to pursue new projects.

You can also think of a municipality taking on debt as an investment. By investing in new schools, improved infrastructure, etc. we’re investing in the future of Worcester while retaining—and attracting new—residents, students, businesses, and jobs. On the flip side, it can’t be a free-for-all. In a perfect world, we’d rebuild all of our schools at once, but we have to be strategic about when we take on new debt so that we don’t spend beyond our means. If we borrow too much, we could end up in a position where we would need to raise taxes.

How exactly do you show the City’s ability to manage its debt?

Those ratings agencies that I mention in the video—Moody’s, S&P Global, and Fitch—evaluate us every year, and we meet with them individually to present the municipality’s economic wellbeing. We don’t quite go line by line through the budget, but we walk them through our revenue streams, budget allocations, and debt obligations and management strategy. We present a snapshot of the current economic picture, as well as an analysis of our debt obligations 30 years into the future. Again, it all boils down to showing that we can pay off our debt.

So it’s a bunch of numbers?

Pictures too! But in all seriousness, while the agencies care about the number crunching, they also want to see results and progress in Worcester’s growth. It’s a chance for us to illustrate our housing, commercial, and institutional development and how that development brings in outside investment and provides jobs and homes for our residents. We paint an overall picture of what makes Worcester an attractive place for investment.

This year we also discussed how the Now | Next long-range plan and municipal operations Strategic Plan will guide our future growth and financial health.

What feedback did we get from the agencies?

I am pleased to say that they are very impressed, both by the amount of development under way and our debt management. Some of the positive highlights the agencies included in their reports were:

Effective budgetary management and financial flexibility

Economic development and growing tax base

Strong higher education and healthcare sectors

Some of areas where that we need to focus on to improve our rating are:

Pension and other postemployment benefit (OPEB) debt obligations, which we are currently paying off very aggressively

Increasing liquidity and reserves

Strengthening resident income

What is the Financial Integrity Plan you mentioned in the video?

Back in 2006, the municipality established a long-term financial plan, which residents may remember as the “Five Point Plan.” Its purpose was to provide a financial strategy and roadmap that we could adhere to as we work to improve our fiscal position, and it helped us increase our bond rating four times across agencies. The plan was updated in 2017 to set the following guidelines:

Create a new High School Construction Stabilization Fund. At the time, this was created for new South and Doherty High Schools, and as of FY25, our High School Construction Fund sits at $7.1 million.

Base City’s borrowing amount on its ability to pay. We currently aim to maintain debt service coverage between 8-10% of the annual operating budget.

Increase reserve level targets to 10% of the annual operating budget. As of FY24, we are at 10.7%.

Create an irrevocable OPEB trust, which we established in FY20.

Memorialize fixed cost budgetary assumptions based on historic trends. This laid out more forward-thinking, anticipated budgeting for areas like snow removal, retirement, and workers’ comp.

Apply excess new growth above budget to create tax relief. This has allowed us to keep our tax levy steady while also funding the Fire Stabilization Fund, School Capital Maintenance Fund, and New High School Fund. Residents save over $23 million a year right now in taxes that would otherwise be due if the Financial Integrity Plan wasn’t followed.

Enhance financial reporting and transparency.

The plan also outlines our allocation of free cash, with 50% going to the Bond Rating Stabilization Fund, 30% to the OPEB Trust, and 20% to Operations.

Who is managing all of this for the City?

Fortunately, we have an amazing team spearheaded by Chief Financial Officer Tim McGourthy and the Department of Administration & Finance, as well as Chief Development Officer Peter Dunn and the Executive Office of Economic Development. I cannot thank them enough for maintaining and crunching all our numbers. We partner with financial advisors who provide invaluable guidance throughout the process. We also have a Bond Counsel, which is a team of outside attorneys that work with us to ensure our i’s are dotted and our t’s are crossed when it comes to our ability to assure investors our debt is 100% sound.

Vastly overwritten, needs a rewrite!

Why does City Manager Batista ignore the hundreds of $100,000 municipal salaries that go to Auburn, Holden, Grafton, Paxton, et alii.

How many city employees neither vote nor pay taxes here.

Will C.M. B. ignore these facts, as instructed by Corporate Corner Offices?

The city needs to take a hard look at the outrageous salaries paid to the police department. Taxpayers even had to increase police pay to teach them how to turn body cameras on and off.